Create marketing funnels in minutes!

Your page? Unpause your account to remove this banner.

72% of S&P 500 Stocks Were Flat or Negative in 2015!

Poor odds for the average investor as that means you barely have a 1 in 4 chance of picking a stock that will go up in value.

Or, you could get the help you need from a PROVEN, VERIFIED stock picking professional: Jim Woods.

His #2 Ranking in the online WORLD means you can count on analysis and performance!

Why is Jim Woods Successful 75% of the Time?

His simple four-step approach blends three pieces: fundamental analysis, technical analysis and news analysis to unearth the very best stocks - every single week.

Let's dive into the four step approach now so you can be confident you're partnering with a proven expert whose singular goal is to help individual investors trounce the markets.

The Importance of Relative Price Strength

You could call this the one indicator to rule them all - but it's only a starting point when researching stocks. Relative Price Strength is by far the best indicator for finding stocks which are likely to outperform the markets because you're buying stocks which are outperforming the market TODAY.

Relative Price Strength measures (or ranks) stocks against ALL stocks on the major exchanges. So a stock with a Relative Price Strength of 95 means its current price performance (or momentum) is outperforming 95% of ALL other stocks. Conversely a stock with a Relative Price Strength of 65...just isn't worth your time.

This principle worked exceedingly well in 2015, as demonstrated by the gains in the so-called “FANG” stocks, i.e., Facebook (FB), Amazon.com (AMZN), Netflix (NFLX) and Google, now Alphabet (GOOGL) (although Jim is a huge Google fan, he really dislikes the name Alphabet).

Each of these stocks scored in the top 95th percentile or higher in terms of price performance vs. all other stocks in the market, and each had stellar performances this year.

Will the FANG stocks lead the market again in 2016? Possibly, but that’s largely an unknown.

What isn’t an unknown is that stocks with strong relative price performance will be the ones leading the market next year, and every year—and those are the stocks that will continue representing the biggest investment opportunities in 2016.

We call it NewsQ - that stands for NewsQuant or quantifying the value of a company based on its positive or negative news flow. More good stories for a company lead to price improvement because the company has "positive" impact from a good reputation.

Think Apple in its heyday -- consistently good press led to more people paying attention to the company, which led to more retail buyers of the stock.

There's another reason, however, that News Flow (and Social Flow) are critical today - and it's the one thing most investors don't know:

The big boys on Wall Street, the Hedge Funds, high-frequency traders use computer algorithms to sift through headlines, social posts, online news, tweets and more and they're looking for ANY EDGE they can get by being first to move on a stock.

Jim's 25 years as a professional stock broker and financial journalist puts you in the driver's seat with his ability to find those stocks that have Positive News Flow.

This is what we call his "W" Factor - it's the one thing that separates him because nobody else in the investment world is doing this for "Main Street" investors.

How does that help you?

By giving you another "indicator" to buy OR sell a stock. When a company suddenly gets hit with negative news, you'll want to be able to move quickly to get out of the way of a falling knife.

On the other hand, when a company is poised to get big headlines, you want to be holding that stock to take advantage of the increase in Relative Price Strength.

And an increase in Relative Price Strength affects your ability to get solid returns on your stocks!

The Four Interlocking Pieces Result in 75% Successful Trades

When you put all four pieces together, Relative Price Strength, Earnings Per Share, News Flow and Chart Patterns, you build a solid case for buying or selling any stock.

The challenge for most investors?

TIME.

You don't have enough of it to do all the research and analysis necessary to find the best stocks.

More often than not it puts investors and traders at a disadvantage because you can't move quickly enough to capture the upside in a stock you eventually decide you do want to buy (or you can't get out of the way fast enough when you want to sell).

Jim has built a long-term, sustainable model to do the research work before he ever makes a recommendation. That process - automating and combining his four inter-locking pieces is how he's been able to maintain a successful track record of 75% Winning Trades with an Average Gain of 17.5% in 2015.

Now It's Your Turn

In 2016, we're pleased to announce the inauguration of "Next Week's Winners" - a unique investment service dedicated to picking ONLY the 10 best stocks each week - every week.

Using his Four Step Process, Jim Woods ranks the Top Ten Stocks to Buy (or hold) every Monday night.

You use that ranking to buy those stocks and hold them for gains of 10% to 30% in a short period of time.

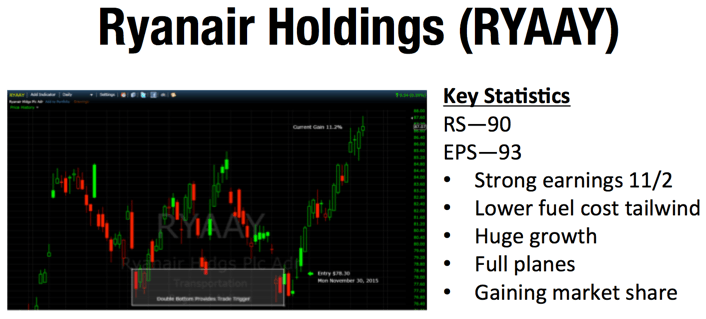

Sometimes, in just days. Like his recent recommendation on Ryanair (RYAAY).

Let's take a look...

Let's review the 4 step process here:

Expert Analysis, High Success Rate, Significant Potential

When we sat down to discuss launching Next Week's Winners with Jim, we asked ONE question:

How can we best help investors and traders be successful?

It comes down to these things:

1. Provide Best in Class stock recommendations on an ongoing basis with validation in fundamental and technical basis. This gives you the confidence to know you're buying a stock for a very good reason (not just some "indicator" or some "hot" name).

2. Provide ongoing trade guidance to help investors and traders ACTUALLY, You know...PROFIT! This gives you the fuel to grow your portfolio all year long. When you have an expert with an AVERAGE gain of 17% per successful trade handing you trades every single week, you have a substantial amount of potential profit to look forward to.

3. Provide IMMEDIATE Action Alerts to help investors and traders close trades on our terms. That means cutting losers quickly and taking action to collect profits.

4. Provide Gains on Trades of 10% to 30% in Short Time Frames to help investors and traders rapidly grow their portfolios. Short term time frames to us are trades that will last one week to one month - that's what we're after here - the best stocks with quick momentum in price.

Because we only want to DATE our stocks - we don't want to MARRY THEM.

At the end of the day, as an investor or trader, we believe these are the only three things you actually WANT from an investment service.

Trades that have a reasonable chance for profits, the knowledge on when to take those profits and a way for you to limit risk (because listen, losing trades do happen) so you always on the right side of Risk to Reward. Less Risk. More Reward - that's what we believe.

That's our promise to our members.

Isn't It Time You Put the #2 Ranked Stock Picker

to WORK FOR YOU!